KEPPEL CORP-FAIR VALUE ESTIMATION

Page 1 of 1

KEPPEL CORP-FAIR VALUE ESTIMATION

KEPPEL CORP-FAIR VALUE ESTIMATION

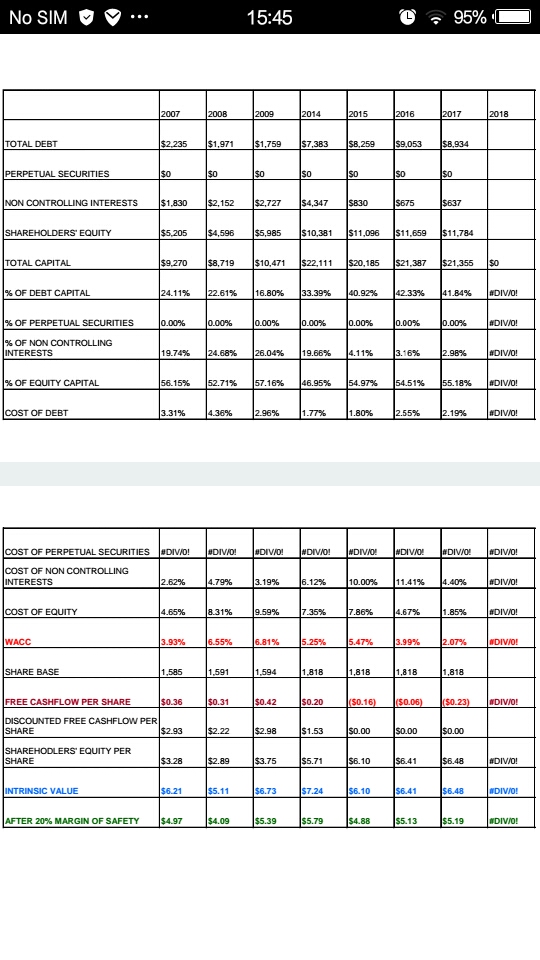

Below table show my calculation on intrinsic value. From the table we can see that first of all we need to work out the weighted average cost of capital, WACC of a company because it is essential to be used as a discount rate to align all future cashflow to present value. I have done up two estimation of intrinsic value and ideal entry price and they were during the period of 2008-2009 and the recent 2015-2016 whereby kepcorp prices crashed. By identifying its intrinsic value and setting a margin of safety for the purchase, given time, an investor's capital will be protected and once our capital is safe, making money is never a question.

Hereby i bring everyone back to 2008 whereby kepcorp's price crash to a low of SGD3.35. From the table, my 2008 intrinsic value was SGD5.11 and ideal entry price after factoring in a 20% safety margin was SGD4.09. Thus, if anyone were to buy at my ideal entry price, after his purchase, prices continue to plunge by another 18%, most likely he would cried like a baby, curse and swear at me for his paper loss. Nevertheless, one year later, 2009, my kepcorp intrinsic value increased to SGD6.73 and that yield a return of close to 65% if an investor had taken my ideal entry price in 2008 for his purchase, in addition kepcorp's price also closed at SGD8.23 at the end of 2009. From the history of 2008, we can conclude that ideal entry price is not a price that after purchased we will be able to see return immediately. Although it is estimated with a margin of safety to protect our capital but it is not an immediate effect. Prices can still continue to fall further if the mkt is at extreme panic, however given time our capital will still be protected because so long the company we buy is fundamentally strong, its intrinsic value will rise over time and therefore be reflected in its mkt price BUT IT TAKE TIME....

With the same valuation method, i bring everyone to the recent crash happened on Jan 2016 and lowest price was SGD4.64. Since it happened in Jan 2016, we can used 2015 ideal entry price of SGD4.88 because 2015 result would be out in Jan 2016. Again this ideal entry price was estimated with the same discount of 20% as safety margin off its intrinsic value, same calculation as what was done in 2008. This time if an investor had taken my ideal entry price to buy he would be very happy because almost immediately after he bought he would see profit. Most probably he will praised me for being very "ZHUN" unlike what had happened in 2008.

Current kepcorp price reflect its intrinsic value. However in order for it to rise above its intrinsic value and stimulate the mkt to push its price to 10 buck base on PE valuation, it will still need to improve on its earning and again that take time. PE valuation is different from cashflow because it is a relative method and it is done via mkt perception of a company's value. Mkt assessment may or may not be right thus for entry it is always good to value a company based on cashflow method and for exit we will based on PE method. Thank you...

Hereby i bring everyone back to 2008 whereby kepcorp's price crash to a low of SGD3.35. From the table, my 2008 intrinsic value was SGD5.11 and ideal entry price after factoring in a 20% safety margin was SGD4.09. Thus, if anyone were to buy at my ideal entry price, after his purchase, prices continue to plunge by another 18%, most likely he would cried like a baby, curse and swear at me for his paper loss. Nevertheless, one year later, 2009, my kepcorp intrinsic value increased to SGD6.73 and that yield a return of close to 65% if an investor had taken my ideal entry price in 2008 for his purchase, in addition kepcorp's price also closed at SGD8.23 at the end of 2009. From the history of 2008, we can conclude that ideal entry price is not a price that after purchased we will be able to see return immediately. Although it is estimated with a margin of safety to protect our capital but it is not an immediate effect. Prices can still continue to fall further if the mkt is at extreme panic, however given time our capital will still be protected because so long the company we buy is fundamentally strong, its intrinsic value will rise over time and therefore be reflected in its mkt price BUT IT TAKE TIME....

With the same valuation method, i bring everyone to the recent crash happened on Jan 2016 and lowest price was SGD4.64. Since it happened in Jan 2016, we can used 2015 ideal entry price of SGD4.88 because 2015 result would be out in Jan 2016. Again this ideal entry price was estimated with the same discount of 20% as safety margin off its intrinsic value, same calculation as what was done in 2008. This time if an investor had taken my ideal entry price to buy he would be very happy because almost immediately after he bought he would see profit. Most probably he will praised me for being very "ZHUN" unlike what had happened in 2008.

Current kepcorp price reflect its intrinsic value. However in order for it to rise above its intrinsic value and stimulate the mkt to push its price to 10 buck base on PE valuation, it will still need to improve on its earning and again that take time. PE valuation is different from cashflow because it is a relative method and it is done via mkt perception of a company's value. Mkt assessment may or may not be right thus for entry it is always good to value a company based on cashflow method and for exit we will based on PE method. Thank you...

Similar topics

Similar topics» M1-FAIR VALUE ESTIMATION

» DBS-FAIR VALUE ESTIMATION

» QAF LTD-FAIR VALUE ESTIMATION

» BYD-FAIR VALUE ESTIMATION

» SPH-FAIR VALUE ESTIMATION

» DBS-FAIR VALUE ESTIMATION

» QAF LTD-FAIR VALUE ESTIMATION

» BYD-FAIR VALUE ESTIMATION

» SPH-FAIR VALUE ESTIMATION

Page 1 of 1

Permissions in this forum:

You cannot reply to topics in this forum|

|

|