BYD-FAIR VALUE ESTIMATION

Page 1 of 1

BYD-FAIR VALUE ESTIMATION

BYD-FAIR VALUE ESTIMATION

BYD is one of the leading battery rechargeable battery manufacturer in the global areana. Its business principally engaged in rechargeable battery and photovoltaic business, handset components and assembly services, as well as automobile business that includes traditional fuel engine vehicles and new energy vehicles (electric vehicles, electric taxis, electric bus, LTR and etc).

In Septembler 2008, Mid American Energy Holding Company, a subsidiary of Berkshire Hathaway entered into agreement with the company and acquired 225million H shares representing approximately 8.25% of the company total capital at presence at about HKD10 per share. In February 2011, a joint venture was established with Daimler AG for jointly research and development of electric vehicles. In 2016, another new institution investor, Samsung, acquired BYD shares at RMB57.40 and became one of its long term investors.

2016 BYD sales revenue increased 29.11% to RMB100.208 Billion which is equivalent to 1.4 times combined revenue of Keppel Corp and Sembcorp in 2016. The breakdown of its sales revenue as follows;

1) Rechargeable battery and photovoltaic business-RMB7.103 Billion-7.1% of total sales revenue

2) Mobile handset components and assembly services-RMB38.083 Billion-38% of total sales revenue

3) Automobiles and related products-RMB55.022 Billion-54.9% of total sales revenue

As revealed by its CEO, Mr Wang Chuanfu, BYD electric vehicles sales increased by 70% in 2016 and it is expected to further rise by 40% in 2017. Given the trend of electric vehicles to replace conventional cars eventually, the growth prospect of the company is enormous. Currently, the development process of electric vehicle is still at the beginning stage and there is still a long way to go before the entire PRC vehicle population to be converted to electric vehicle. The competitive advantage that BYD possessed is the ability to connect its rechargeable battery business with its electric vehicle business which give an edge for BYD when compared to its competitors. As such, the company is able to manufacture its electric vehicle at a more moderate cost and able to keep a more competitive pricing in the industry.

Operating profit before interest, tax, amortisation and depreciation rose at an explosive rate of 66.6% to RMB16.485 Billion in 2016. Operating profit margin improved from 2015 of 12.75% to 2016 of 16.45% represented the companies ability to price or keep its operating cost down.

Debt ratio had been increasing over the past few years due to the company gearing up for investments in electric vehicles manufacturing plants and with the reduced in gearing to 89% in 2016, it show that the company is ripping its investment return. Another indicator that show the company is progressing well on its fixed assets investment is the increased in operating cashflow to its interest cost at 11 times as compared to only 8 times in 2015. Although gearing had fallen, it is still considered high, hence to invest in this stock, one should assign a relatively small fraction of its portfolio and not over exposed to high debt company.

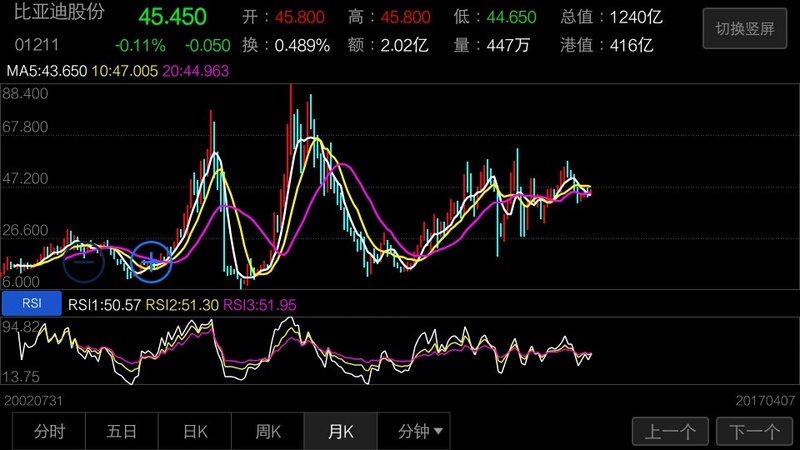

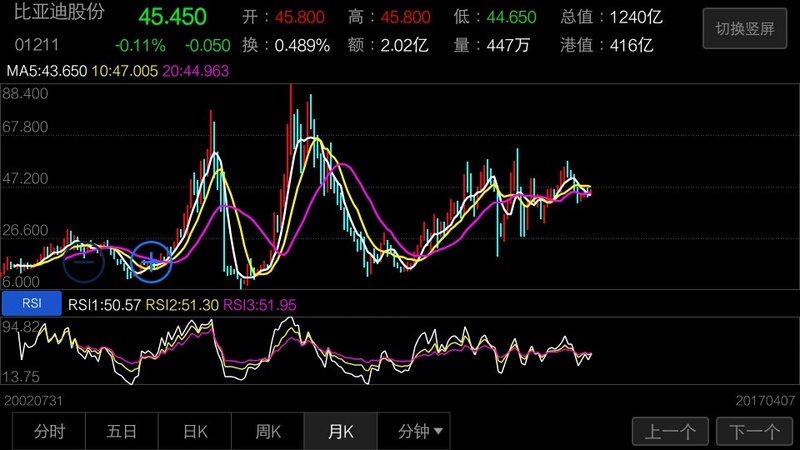

BYD is a very volatile stock, thus investor must be able to endure volatilities while holding your position with it. Thus to buy, one must provision at least 50% safety margin so as to keep our capital safe given time. This is a strong growth stock given the robust development of electric vehicle in the future, thus it is advisable to take some risk with limited portion of your portfolio when given the opportunity to buy. I hereby correct my previous estimated fair value due to error of ommiting the increased in its share capital in 2016. Hence my corrected fair value for BYD currently stand at HKD47.89 and ideal entry price at HKD23.82.

Investors are advised to read up more on your own and have it placed under watchlist for future opportunity. Thank you.

In Septembler 2008, Mid American Energy Holding Company, a subsidiary of Berkshire Hathaway entered into agreement with the company and acquired 225million H shares representing approximately 8.25% of the company total capital at presence at about HKD10 per share. In February 2011, a joint venture was established with Daimler AG for jointly research and development of electric vehicles. In 2016, another new institution investor, Samsung, acquired BYD shares at RMB57.40 and became one of its long term investors.

2016 BYD sales revenue increased 29.11% to RMB100.208 Billion which is equivalent to 1.4 times combined revenue of Keppel Corp and Sembcorp in 2016. The breakdown of its sales revenue as follows;

1) Rechargeable battery and photovoltaic business-RMB7.103 Billion-7.1% of total sales revenue

2) Mobile handset components and assembly services-RMB38.083 Billion-38% of total sales revenue

3) Automobiles and related products-RMB55.022 Billion-54.9% of total sales revenue

As revealed by its CEO, Mr Wang Chuanfu, BYD electric vehicles sales increased by 70% in 2016 and it is expected to further rise by 40% in 2017. Given the trend of electric vehicles to replace conventional cars eventually, the growth prospect of the company is enormous. Currently, the development process of electric vehicle is still at the beginning stage and there is still a long way to go before the entire PRC vehicle population to be converted to electric vehicle. The competitive advantage that BYD possessed is the ability to connect its rechargeable battery business with its electric vehicle business which give an edge for BYD when compared to its competitors. As such, the company is able to manufacture its electric vehicle at a more moderate cost and able to keep a more competitive pricing in the industry.

Operating profit before interest, tax, amortisation and depreciation rose at an explosive rate of 66.6% to RMB16.485 Billion in 2016. Operating profit margin improved from 2015 of 12.75% to 2016 of 16.45% represented the companies ability to price or keep its operating cost down.

Debt ratio had been increasing over the past few years due to the company gearing up for investments in electric vehicles manufacturing plants and with the reduced in gearing to 89% in 2016, it show that the company is ripping its investment return. Another indicator that show the company is progressing well on its fixed assets investment is the increased in operating cashflow to its interest cost at 11 times as compared to only 8 times in 2015. Although gearing had fallen, it is still considered high, hence to invest in this stock, one should assign a relatively small fraction of its portfolio and not over exposed to high debt company.

BYD is a very volatile stock, thus investor must be able to endure volatilities while holding your position with it. Thus to buy, one must provision at least 50% safety margin so as to keep our capital safe given time. This is a strong growth stock given the robust development of electric vehicle in the future, thus it is advisable to take some risk with limited portion of your portfolio when given the opportunity to buy. I hereby correct my previous estimated fair value due to error of ommiting the increased in its share capital in 2016. Hence my corrected fair value for BYD currently stand at HKD47.89 and ideal entry price at HKD23.82.

Investors are advised to read up more on your own and have it placed under watchlist for future opportunity. Thank you.

Last edited by Admin on Sun Apr 09, 2017 3:35 pm; edited 1 time in total

Similar topics

Similar topics» M1-FAIR VALUE ESTIMATION

» DBS-FAIR VALUE ESTIMATION

» QAF LTD-FAIR VALUE ESTIMATION

» SPH-FAIR VALUE ESTIMATION

» SJM HOLDING LTD-FAIR VALUE ESTIMATION

» DBS-FAIR VALUE ESTIMATION

» QAF LTD-FAIR VALUE ESTIMATION

» SPH-FAIR VALUE ESTIMATION

» SJM HOLDING LTD-FAIR VALUE ESTIMATION

Page 1 of 1

Permissions in this forum:

You cannot reply to topics in this forum|

|

|